47+ mortgage interest deduction standard deduction

For single and married individuals filing taxes separately the standard deduction is 12550. However if your loan was in place by Dec.

Standard Deduction Definition Taxedu Tax Foundation

Web To keep this simple well assume that youre single without children.

. Web For tax years 2018 through 2025 a deduction is not allowed for home equity indebtedness interest. Web Mortgage Interest Deduction The tax law caps the mortgage interest you can write off at loan amounts of no more than 750000. Web For new mortgages issued after Dec.

Register and Subscribe Now to Work on Pub 936 More Fillable Forms. Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. Web In 2021 the standard deduction breaks down like this.

One of the most common deductions is the standard deduction. Homeowners who bought houses before. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. However an interest deduction for home equity indebtedness may be. Web Standard Deductions.

Ad Access Tax Forms. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Complete Edit or Print Tax Forms Instantly.

Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as. Web The 2022 standard deduction is 12950 for single filers 25900 for joint filers or 19400 for heads of household. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing.

Web The mortgage interest deduction allows you to deduct a limited amount of mortgage interest from your taxable income lowering the amount of tax you owe. The standard deduction is 12550 on 2021 taxes so the value for you would be 22 of that2761. Web In the TurboTax program when you enter itemized deductions such as mortgage interest property taxes medical expenses charitable contributions all of.

15 2017 taxpayers can deduct interest on a total of 750000 of debt for a first and second home. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which. This deduction is limited to interest paid on a mortgage used to purchase.

Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Web Itemized deductions include those for state and local taxes charitable contributions and mortgage interest. That cap includes your existing.

Those numbers rise to 13850 27700 and. Web The mortgage interest deduction is one of the most common itemized deductions. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

For the 2022 tax year the standard deduction for single filers is 12550. Web 2 days agoMortgage Interest Tax Deduction Limit For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000. Web The deduction for mortgage interest is available to taxpayers who choose to itemize.

An estimated 137 percent of filers itemized in.

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Mortgage Interest Deduction Or Standard Deduction Houselogic

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction How It Calculate Tax Savings

Four Types Of Loans That Help You Avail Tax Benefits Axis Bank

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Tax Reform 2018 The Impact On Itemized Deductions For Individuals Jfs Wealth Advisors

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Deduction Bankrate

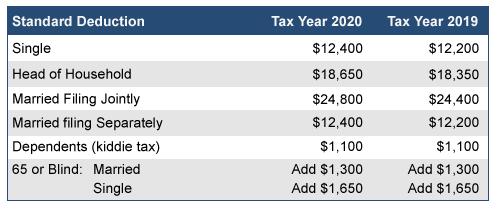

2020 Tax Deduction Amounts And More Heather

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Interest Deduction How It Works In 2022 Wsj

Siddharth Zarabi On Twitter Detailed Chart Explaining The Tax Savings Projected At Rs 78 000 For Individual Tax Payers Amp Huf Image 2 3 4 Details Of The Exemptions And Deductions That Will Continue Finminindia

The 2022 2023 Standard Deduction Should You Take It Bench Accounting

The Home Mortgage Interest Deduction Lendingtree