Payback period calculation formula

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The longer the payback period of a project the higher the risk.

Calculating Payback Period Youtube

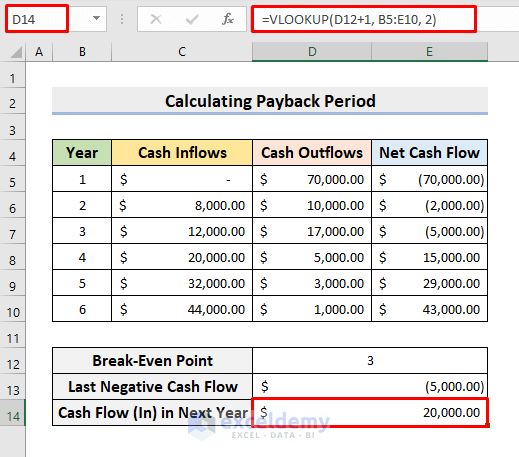

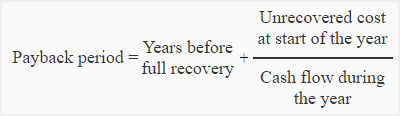

To find exactly when payback occurs the following formula can be used.

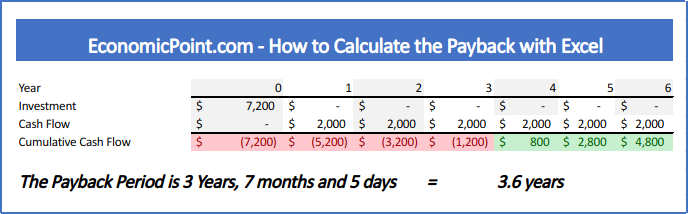

. Payback Period Formula. The opening and closing period cumulative cash flows are 900000 and 1200000 respectively. In its simplest form the calculation process consists of dividing the cost of the initial investment by the annual cash flows.

It ignores the timing of cash flows within the payback period the cash flows after the end of payback period and therefore the total project return. The discounted payback period is a capital budgeting procedure used to determine the profitability of a project. For instance lets say you own a retail company and are considering a proposed growth strategy that involves.

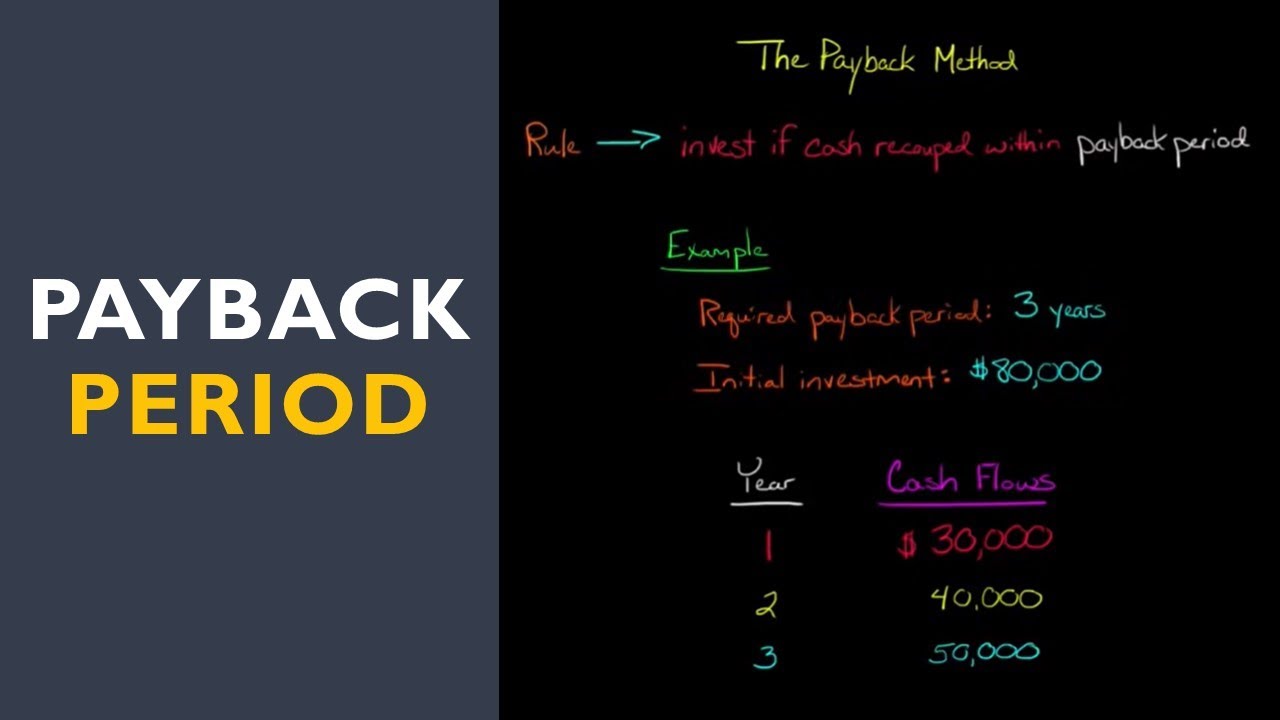

People refer to ROI when discussing what they get back for their input. Payback Method Example 2. The payback period does not factor in churn or.

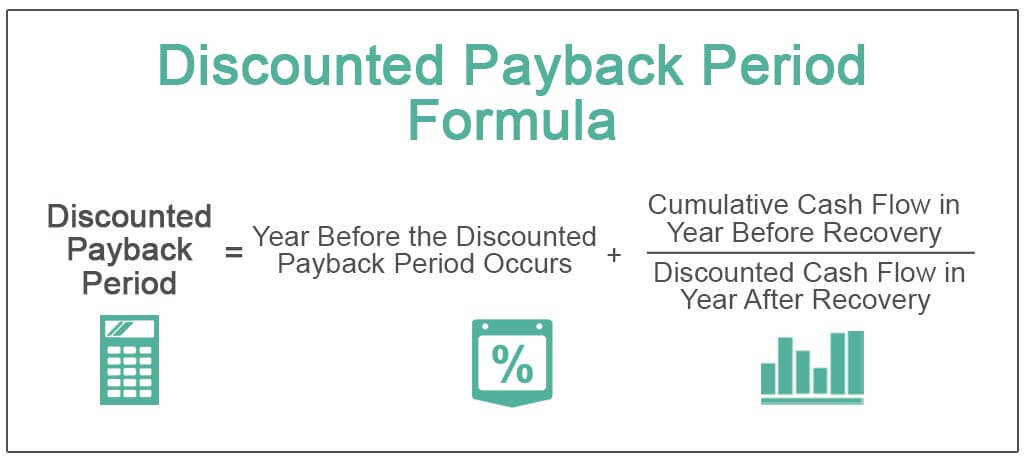

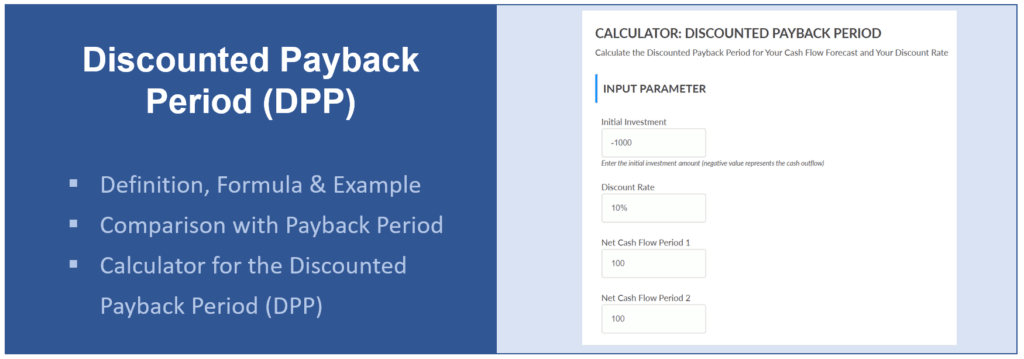

It ignores the time value of money. Thus its use is more at the tactical level than at the strategic level. Discounted Payback Period Year before the discounted payback period occurs Cumulative cash flow in year before recovery Discounted cash flow in year after recovery Example 2 A project is having a cash outflow of 30000 with annual cash inflows of 6000 so let us calculate the discounted payback period in this case assuming.

The following example illustrates the problem. Next the change in total costs and change in quantity ie. A discounted payback period gives the number of years it.

NPV C i1 1r 1 C i2 1r 2 C i3 1r 3 X o. What is the Coefficient of Determination Formula. When deciding whether to invest in a project or when comparing projects having different.

Annual cash inflows during the payback year 50000. Using the averaging method the initial amount of the investment is divided by annualized cash flows an investment is projected to generate. There are several types of payback period which are used during the calculation of break-even in business.

Also this period does not consider the cash. μ Mean of the data set n Number of readings in the data set. Payback Period Formula.

The payback period formula does not account for the output of the entire system only a specific operation. Payback Period Initial Investment Yearly Cash Flow. Then add together your total marketing and sales expenses and divide that total by the number of new customers acquired during the period.

Mileage calculation provided by the Australia Taxation Office - 72 cents per kilometre from 1 July 2020 for the 202021 income year. Marginal Cost Change in Costs Change in Quantity Marginal Cost Example Calculation. ROI is used as a concept and a specific formula.

Payback Period Formula Total initial capital investment Expected annual after-tax cash inflow 2000000221000 9 YearsApprox. The net present value of the NPV method is one of the common processes of calculating the payback period which calculates the future earnings at the present value. Coefficient of Determination Formula Table of Contents Formula.

Where R is the specified return rate per period. This will help you narrow down the scope of your data. To a maximum of 5000 business.

Applying the formula to the example we take the initial investment at its absolute value. The average payment period is usually calculated using a years worth of information but it may also be useful evaluating on a quarterly basis or over another period of time. However ROI is a true metric that can be calculated as a ratio or percentage.

Explanation of Net Present Value Formula. Payback Period 3 1119 3 058 36 years. C i1 is the consolidated cash arrival during the first period.

Get 247 customer support help when you place a homework help service order with us. Discounted payback period will usually be greater than regular payback period. The payback period of a given investment or project is an important determinant of whether.

In other words if we have dependent variable y and independent variable x in. Payback reciprocal is the reverse of the payback period and it is calculated by using the. The calculation of the payback method is not an accurate method as it ignores the time value of money which is a very important concept.

Some of these are. Where x i i th reading in the data set. Examples of Uncertainty Formula With Excel Template Lets take an example to understand the calculation of Uncertainty in a better manner.

The payback period is the length of time required to recover the cost of an investment. The discounted payback period of 727 years is longer than the 5 years as calculated by the regular payback period because the time value of money is factored in. To calculate the payback period you need.

Although the payback period can be a useful calculation for individuals and companies considering. The final step is to calculate the marginal cost by dividing the change in total costs by the change in quantity. Investments with higher cash flows toward the end of their lives will have greater discounting.

So the desired period of time may dictate which financial statements are necessary. A water heaters energy efficiency is determined by the energy factor EF which is based on the amount of hot water produced per unit of fuel consumed over a typical day. Between mutually exclusive projects having similar return the decision should be to invest in the project having the shortest payback period.

It does not take into account the social or environmental benefits in the calculation. Features of the Payback Period Formula. Payback Period Formula Averaging Method.

The discounted payback period is a capital. Discounted Payback Period. In statistics coefficient of determination also termed as R 2 is a tool which determines and assesses the ability of a statistical model to explain and predict future outcomes.

The NPV formula has two parts. As mentioned above Payback Period is nothing but the number of years it takes to recover the initial cash outlay invested in a particular project. Payback Period Initial Investment Cash Flow Per Year.

As a concept it can measure profitability or efficiency. Disadvantages of the payback method. C i3 is the consolidated cash arrival during the third period etc.

Step 2 Calculate the CAC Payback Period. CAC MRR and ACS or MRR GM of Recurring Revenue Since I am using MRR the formula will calculate the number of months required to pay back the upfront customer acquisition costs. The first step in calculating your customer acquisition cost is to determine the time period that youre evaluating for month quarter year.

The payback period formula has some unique features which make it a preferred tool for valuation. Here is how to calculate the average payment period equation. The basic formula to calculate ROI is.

This will help you determine the dollar savings and payback period of investing in a more energy-efficient model which will may have a higher purchase price. ROI Net Profit Total Investment 100. Payback Period Years before full recovery Not recovered cost at the beginning of the year Cash inflow throughout the year.

Production volume must be tracked across a specified period. The calculation will incorrectly yield a payback period that is too soon. You just need to first find out the cumulative cash inflow and then apply the following formula to find the payback period.

Payback Period Formula. C i2 is the consolidated cash arrival during the second period. This means that it does not take into account the fact that 1 today is worth more than 1 in one years time.

Calculation of not recovered.

Discounted Payback Period Meaning Formula How To Calculate

How To Calculate Payback Period In Excel With Easy Steps

What Is Payback Period Formula Calculation Example

Payback Period Formula And Calculator Excel Template

Undiscounted Payback Period Discounted Payback Period

How To Calculate The Payback Period Youtube

Discounted Payback Period Definition Formula Example Calculator Project Management Info

How To Calculate The Payback Period With Excel

Payback Period Formula And Calculator Excel Template

Payback Method Formula Example Explanation Advantages Disadvantages Accounting For Management

How To Calculate The Payback Period With Excel

How To Calculate The Payback Period With Excel

What Is Payback Period Formula Calculation Example

Undiscounted Payback Period Discounted Payback Period

Calculate The Payback Period With This Formula

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube

How To Calculate The Payback Period In Excel